Also the listed options are. By using derivative contracts one can replicate the payoff of the assets.

Currency Options And Its Benefits Derivatives Forex Management

The more volatile the underlying or the broad market the higher the premium paid by the option buyer.

. For example imagine an. Lowest costs for low high frequency options traders. Advantages of OTC FX options.

Take Your Options Trading to the Next Level with Innovative Tools Educational Resources. The best rated Forward Contracts And Currency Options Advantages Disadvantages broker IC Markets offers competitive offers for Forex CFDs Spread Betting. We are dealing in Rateaudit Ratecheck Transaction Process Outsourcing forex risk advisory trade finance.

This is a substantial advantage of futures over options. Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market. Explain the conditions regarding your expectations of the.

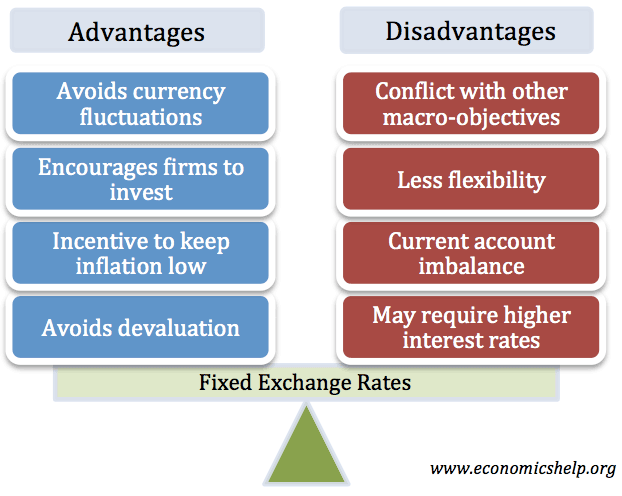

Advantages And Disadvantages Of Devaluation Economics Help. First an Australian corporation can uses currency options to get right in order to hedge its exposure in euros. Cara Nak Buat Personal Hranding.

With OTC FX options you pay a. It is considered that derivatives increase the efficiency of financial markets. Forex or foreign currency.

The Advantages of Currency Options. Ad With over 40 years experience in options trading we have a robust set of tools. As an investor you need to ensure that the benefits of an investment strategy can offset the.

As such an investor can obtain an option position similar to a stock position but at huge cost savings. Currency trading is a specialized skill and requires familiarity with the economies of the countries whose currencies you will trade as. Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market.

The main advantage of buying put options is they give investors the chance to speculate on securities that they feel may be headed for a fall in price. The most common advantages include easy pricing high liquidity and risk hedging. Unlike currency forwards where you buy currency for a specific date in the future and are locked into the deal.

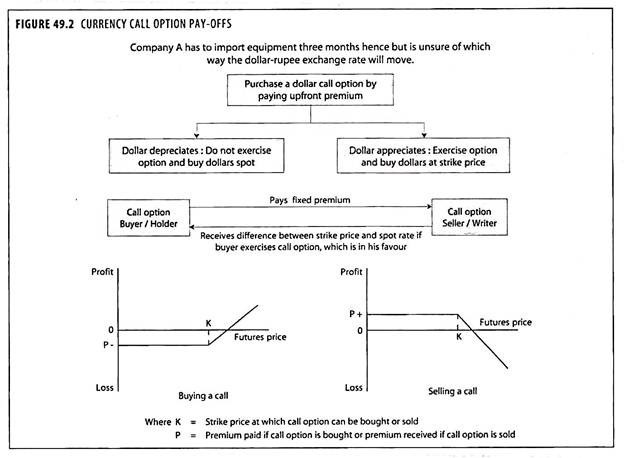

What are some advantages and disadvantages of currency options as compared to forward contracts when hedging payables. Advantages of using currency options Euros. Or it could use foreign currency forwards and options to minimize the impact of exchange rate.

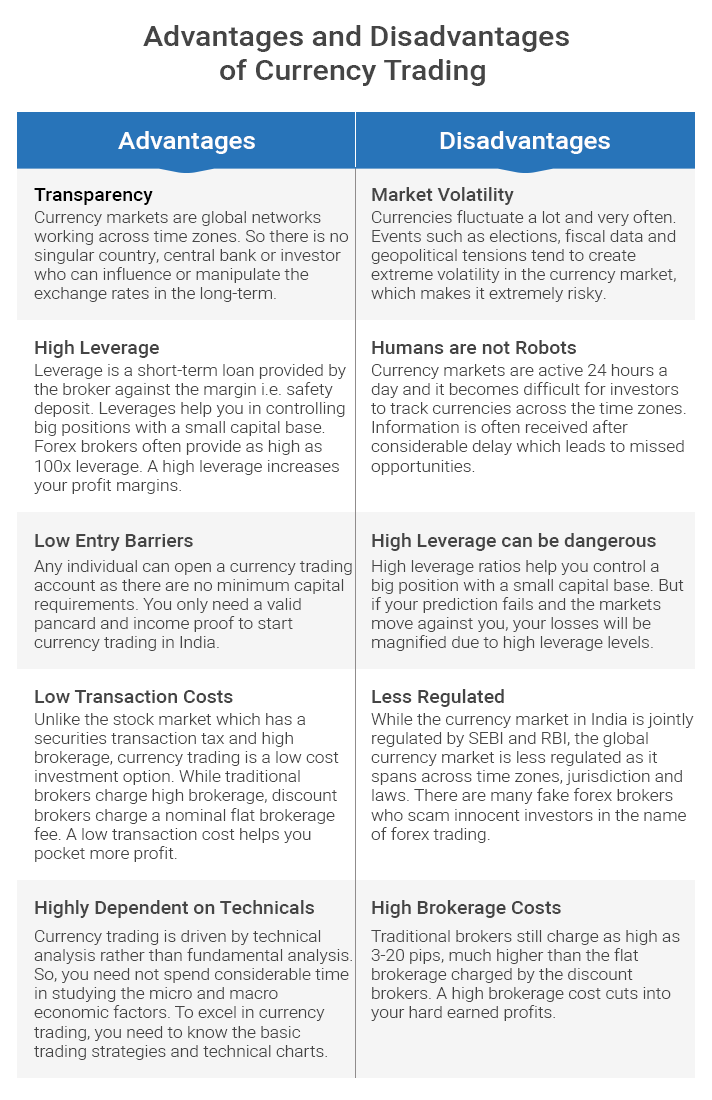

Advantages and disadvantages of sea transport for international trade. Currency hedging is a strategy that allows an investor to minimize and control the risks involved in foreign investment particularly one that relates to foreign currency trading. There are many advantages of currency options trading.

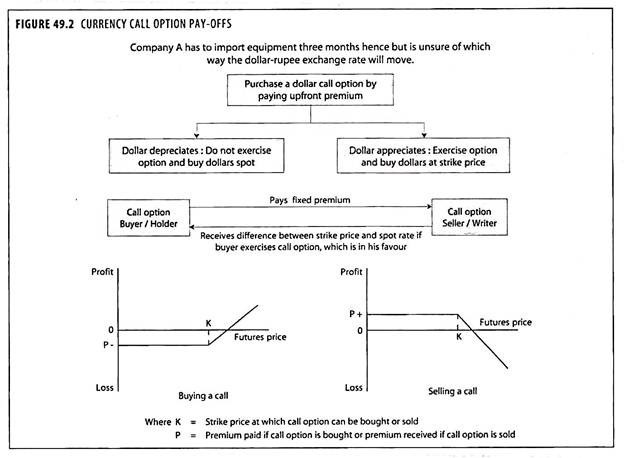

Myforexeye is one of the leading full foreign currency exchange in all over India. The main difference between the two is that in currency options trading their values are determined at a specific time period. Advantages Of Fixed Exchange Rates Economics Help.

Like any other type of moneymaking approach hedging has both advantages and disadvantages. Options have great leveraging power. There are many advantages and disadvantages of future contracts.

Advantages Of Fixed Exchange Rates Economics Help

Free Currency Tips Stock And Nifty Options Tips Commodity Tips Intraday Tips Rupeedesk Shares Day Day Trading Stock Options Trading Stock Trading Strategies

0 Comments